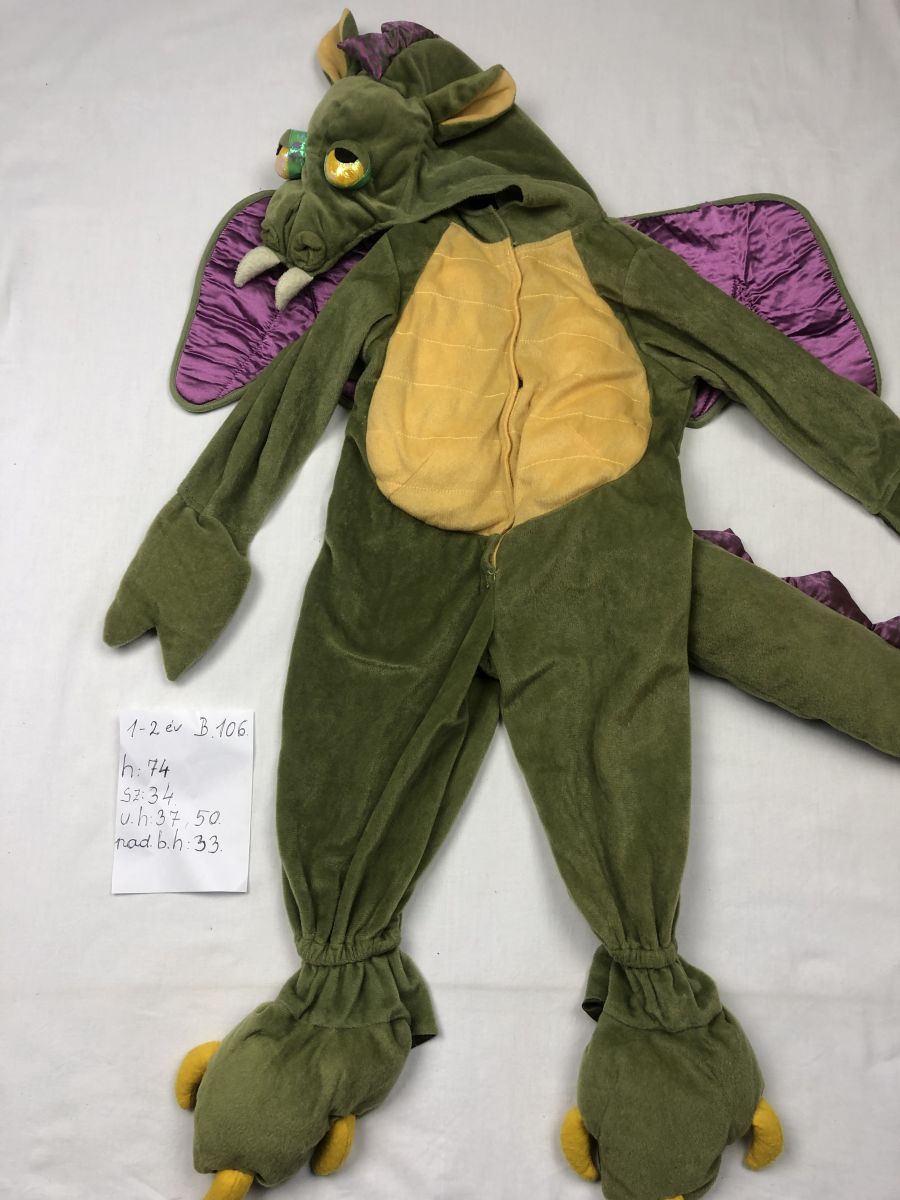

Rubies 2885339 Sárkány kapucnival unisex gyermek jelmez 1-2 éves gyerekeknek való méretben - eMAG.hu

Vásárlás: Krokodil, Sárkány és Dinoszaurusz 3 az 1-ben jelmez, 104-es méret 2-3 éveseknek Gyerek jelmez árak összehasonlítása, Krokodil Sárkány és Dinoszaurusz 3 az 1 ben jelmez 104 es méret 2 3 éveseknek boltok

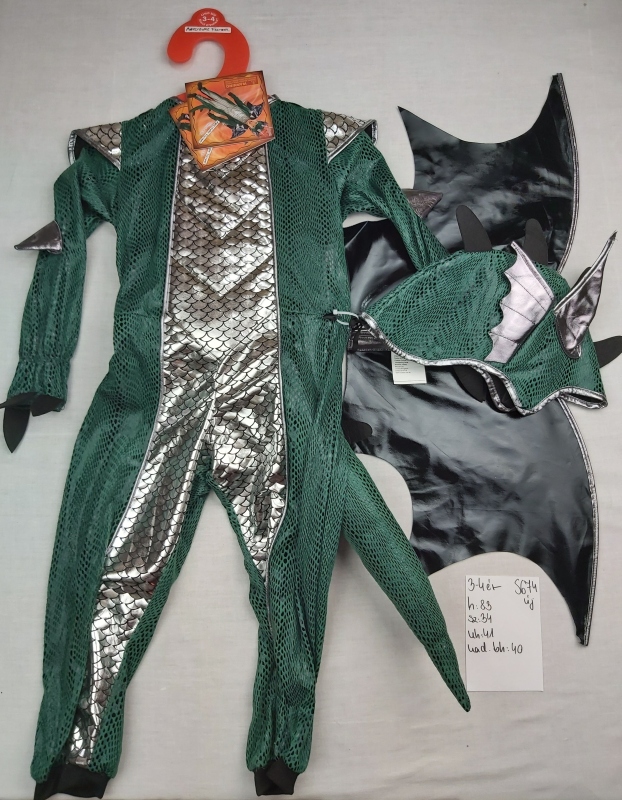

6-8 év zöld dínó,sárkány, vagy krokodil jelmez, overall 2800ft - Gyerek, kamasz jelmezek, fellépőruhák